The field of finance and accounting is no stranger to the emergence of online software, platforms and applications. Along with the availability of learning management systems and online employee training tools, there are accounting software on the market, geared to cater to a variety of business owners, accountants, managers, and company decision makers.

Data from the International Telecommunication Union (ITU) shows that 66% of the world’s population, or 5.3 billion people, use the Internet today. This represents a huge jump of 24% compared to 2019, which had 4.2 billion internet users before the pandemic (ITU, 2022). While COVID-19 is not the only reason for this increase, it is clear how much technology has shaped the use of the Internet not only for entertainment but also for work. In this fast-paced digital environment, it’s important to note which accounting platform is the most ideal to use, especially since finance and accounting depend on strictly quantitative results.

This list outlines the leading platforms on the market, their key features and pricing options. It also deals with the latest accounting software trends and statistics to help you choose the best accounting software for your company or business.

Best Accounting Software Table of Contents

- Statistics for accounting software

- Accounting Software Trends

- List of Best Accounting Software

- Statistics for accounting software

Business Research Company (2022) reports that the global accounting software market is expected to grow from $13.94 billion in 2021 to $15.71 billion this year at a compound annual growth rate (CAGR) of 12.65 percent. Furthermore, it is also estimated that the market will grow at a CAGR of 11.34% to reach USD 24.13 billion by 2026. The report also noted that automation drives high demand and growth for accounting software in the market.

- Source: Business Research Company

In comparison, more recent reports show different but close estimates when it comes to accounting software market value. For example, Digital Journal’s Online Accounting Software Market Report (2022) shows a CAGR of 11.05% for the market, which will reach $6,056.28 million by 2027. The software industry will grow to USD 2.33 billion by 2026 with a CAGR of 7.14%.

All three reports primarily focused on top business accounting software by enterprise size, market size, type, component, deployment mode, and geographic location. One thing the three projections have in common is the steady growth of the accounting software market in just a few years. This tells you that there is a growing need and interest in acquiring accounting software.

With the rise of digitalization and automation, it is only inevitable that some skills and some professions gradually become redundant. In fact, the World Economic Forum (WEF) reported that at least 43% of the businesses they surveyed in their study expressed a reduction in their workforce due to the use of technology. Meanwhile, 41% suggested expanding work-specific tasks, and 34% wanted to use technology integration in their workforce. These numbers are due to automation in the workforce as well as the recession caused by the pandemic. The WEF calls this a “double-barrier” scenario. In addition, their report also predicts that redundant roles will decrease from 15.4% to 9% by 2025, soon leaving 85 million jobs due to the division of labor between humans and machines. Will be home. Their study also shows that accounting, bookkeeping, payroll clerks, accountants, and auditors are among the top five occupations in declining demand.

Source: World Economic Forum

An IBM study even found that among cross-industry business processes, the most automated categories were managing financial resources (accounting payables and expenses, payroll, revenue accounting, product recalls and audits), managing customer services , and include physical product delivery. In contrast, the least automated process involves strategy and decision-making or vision development.

Of course, this does not mean that the accounting profession itself will become obsolete. Perhaps, integrating technology can help tasks and processes become faster, more efficient, and less prone to error. Current accounting software statistics show that technology is driving the process.

Take the case of a recent survey by Sage (2020). It has found that among accountants in the UK:

65% of respondents expressed that the two most important concerns for accountants in the next five years are the automation of processes and workflows.

66% revealed that the first or second positive result of Making Tax Digital (MTD) was increased automation.

83% of them confirmed that digitization is a necessity in the field and must be invested in rapidly to keep up with the market and growing demand.

84% consider potential digital native employees to be an asset due to their knowledge of the digital landscape, thus urging firms to nurture them, and

91% of them believe that new technology adds value to the business.

State of Digitization in Accounting

Similarly, the 2021 Benchmark Survey revealed that 38% of accountants spent more than a quarter of their time working on manual tasks compared to 11% of the accounting teams’ time spent on manual tasks (Airbase, 2020).

Accounting Software Trends

The use of accounting software has increasingly provided benefits to accounting firms as well as their clients. The following accounting software trends in the digitization of accounting reflect the developments that will shape the use of technology in the accounting process.

The growing role of data security. Accounting firms store and manage sensitive business information, and security breaches can put client data at risk. In 2021, for example, more than three out of five companies were targeted by software supply chain attacks. In addition to serious financial loss, compromised data can damage your reputation and result in lawsuits from affected clients. That’s why accounting software vendors are making sure users stay safe by integrating the latest encryption into their software and backing up accounting data.

Using Data Analytics for Accounting. One accounting software trend is the use of artificial intelligence (AI) in managing large amounts of data. AI helps improve finance and accounting functions in four key areas: audit analytics, purchase-to-pay, order-to-cash, and financial planning (Le Clair, 2022). In addition, AI was able to elevate these processes through the use of risk assessment, data standardization, and robotic process automation (RPA), text analytics, as well as ML-based statistical modeling.

Diffusion of Cooperative Accounting. The shift to remote and hybrid work has created a new level of collaboration in organizations. A major challenge at the start of a pandemic is how teams can collaborate in practice, which requires the right systems. The best accounting software enables remote teams to work together on one platform and exchange information and ideas with just a few clicks. Thus, an accounting software trend is the integration of tools .

NetSuite

Oracle NetSuite Dashboard

NetSuite is a cloud-based software that offers a combination of ERP applications, finance, inventory management, HR processes, professional services automation, and omnichannel commerce. It aims to streamline the accounting process in one place and generate real-time data. The software offers opportunities for startups, fast-growing businesses, family-owned to mid-sized businesses, and PE- or VC-backed businesses. They also address manual processes, simplify data access, reinforce data accuracy, and ensure consistent compliance with standards and internal policies.

NetSuite Key Features:

- Get 360 visibility and optimization on cash management.

- Speed up the process with better accounts receivable tools.

- Save time and avoid late fees on accounts payable.

- Manage local and global tax management details.

- Use a fully integrated fixed assets solution.

- Promote collections and reduce outstanding sales.

- Pricing:

- From the quote

. QuickBooks

Intuit QuickBooks Dashboard

QuickBooks is a cloud accounting software that caters to self-employed consumers and small to medium-sized businesses, as well as various industries such as retail, restaurants and non-profit organizations. The platform offers real-time access, increased reporting accuracy, automated invoicing, and customizable invoice templates. It is also capable of hosting multiple users while protecting your data and allows seamless collaboration between employees or accountants. They also provide other services, including live bookkeeping, payroll, point of sale, and time tracking.

Key Features of QuickBooks:

- Easily create and project estimates, reports and insights.

- Manage bills and sync apps for easy cash flow management.

- Manage payrolls with same-day direct deposit.

- Optimize operations with an inventory calculator and automatic GPS mileage tracking.

- Classify sales tax and avoid tax deductions.

- Integrate information from QuickBooks to create customer profiles.

- Record global transactions with advanced multi-currency support.

- Pricing:

QuickBooks offers plans for different business sizes. These range from $30/month to $200/month. It also has a self-employed/independent contractor plan, available for $15/month. For those interested, the vendor offers a 30-day free trial and new customers get 50% off their subscription for the first three months.

. Sage intact

Sage Intact Dashboard

Sage Intact is one of the world’s leading cloud financial software. Apart from accounting and ERP, it also offers planning, analytics, and HR and payroll services for all types of clients. It has a range of functionalities, such as advanced functionality, which helps automate and streamline financial processes, dashboards and reporting, which provide real-time collaboration, accurate insights, and interactive visual summaries, and simplified billing management. . It also boasts of releasing new products every year.

Sage Intact Key Features:

- Reduce accounts payable processing time using automation.

- Accelerate daily cash transactions and quote-and-order-to-cash cycles.

- Simplify common ledger tasks with its intelligent GL™ powered AI.

- Easily comply with tax requirements using Sages Intact Multi-Tax.

- Ensure healthy stock levels using the inventory management module.

- Automate revenue recognition performance.

- Track billable hours and expenses using time and expense management features.

- Pricing:

- From the quote

Zero

Zero Dashboard

Xero offers its accounting software to small businesses, accountants and bookkeepers. It claims to simplify day-to-day business by automating manual tasks, updating records, and creating a space to collaborate effectively. Its platform also allows connection to more than 1,000 third-party apps. In addition, it has tools specific to retail and construction businesses, Amazon sellers, and nonprofits.

Zero Key Features:

- Generate multi-currency reports with its reporting module.

- Store and schedule bills and online payments through automation.

- Be automated and paperless with sales tax returns and expense reports.

- Keep track of secure bank feeds anytime.

- Categorize bank transactions in bulk.

- Securely manage data and files with employees.

- Easily customize reporting and trail inventory and purchase orders.

- Pricing:

- Xero offers three pricing plans: the Starter Plan for $25/month, the Standard Plan for $40/month, and the Premium Plan for $54/month.

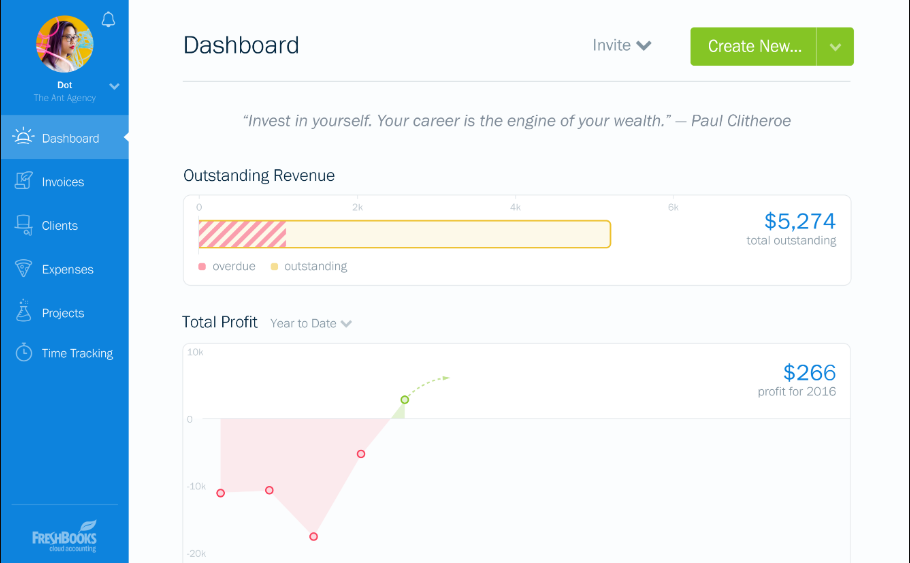

Fresh books

FreshBooks Dashboard

FreshBooks is designed for freelancers, self-employed professionals, startups and high-growth businesses. A product of a four-person design agency looking to simplify accounting for small business owners, the platform is known for providing on-the-go, real-time accounting tools. It is equipped with basic and advanced accounting, expense tracking, tax preparation as well as online invoicing features. It also syncs data across devices.

ePromis ERP Cloud

ePromis ERP Cloud Dashboard

ePromis ERP Cloud is one of the products that SaaS platform offers with ePromis SME, HCM, CRM, EAM Cloud. It aims to create “a futuristic platform to transform them all” to harness time, money and efficiency. It uses built-in business intelligence that provides access to real-time data on any device, and helps users move to automated work. The app also offers ePromis Financials that can perform project and budget management, accounting, and other ERP functions so you can reduce redundancies and errors.

ePromis ERP Cloud Key Features:

- Streamline all business processes with an enterprise cloud platform.

- Easily use multiple cloud services in one hub through integration.

- Monitor data and get accurate estimates anytime, anywhere.

- Improve compliance with its guidelines function.

- Generate professional-looking reports with its analytical tools.

- Expand workloads with multi-currency, multi-company, multi-entity processes.

- Pricing:

- From the quote

Vic. ai

Vic.ai Dashboard

Vic.ai is an accounting software that uses artificial intelligence (AI) to replace rule-based methods to avoid human errors in accounting and financial services. It claims to increase invoice processing productivity by 355 percent through a fully automated accounts payable process. It also claims 80% less time for manual tasks and 200% return on investment. Its AI algorithm accurately compares accounts payable and simulates human decision-making so it can do the work for you, resulting in world-class, error-free data.

Vic.ai Key Features:

- Explore new opportunities with full automation/AI delivery.

- Integrate files and data with ease.

- Reduce time for approval flow.

- Compatible with any ERP system worldwide.

- Check out the latest and accurate analysis through its hands-free rating.

- Pricing:

- From the quote

Oddo Accounting

Odoo Accounting Dashboard

Odoo Accounting is one of the products offered by Odoo, a collection of open source business apps. It is a user-friendly accounting software with a compact interface where everything is easily accessible. It uses time-saving tools such as automated processes, seamless file imports and exports, and the ability to pay multiple invoices. It encourages paperless transactions by turning images or files into organized lists and using AI to help reduce errors. Other apps that Odoo offers are for sales, marketing, inventory, project management and HR.

Key Features of Odoo Accounting:

- Create automatic reconciliations with the Smart Reconciliation Tool.

- Create error-free reports with AI-powered invoice digitization.

- Work with clients on an easy-to-use platform designed for fiduciaries.

- Integrate legal statements and reports and access them from any device.

- Simplify global transactions with its multi-currency and multi-company features.

- Pricing:

Odoo Accounting has an app plan available for free. For companies leveraging multiple apps from Odoo, it offers a standard plan for $11.20/month and a custom plan for $17/month. The vendor also provides a discount for the first 12 months of subscription.

Accounts IQ

Accounts IQ Dashboard

AccountsIQ is another cloud accounting software that provides automation and business intelligence that is perfect for mid-sized companies. With its top-of-the-line automation, you can digitize data entry, simplify collaboration, and sync bank updates anytime. It also allows for quick integration into other systems and provides a three-level chart of accounts that analyzes and reports on the data you want. It features a role-based dashboard with 250 pre-built report templates and leaves plenty of room for customization.

Key Features of Accounts IQ:

- Accomplish advanced reporting with “anywhere” accounting.

- Review information with confidence with automated tasks.

- Customize financial reports with six analytical dimensions.

- Classify general ledgers with business intelligence software.

- Handle tax details accurately with its Making Tax Digital plan.

- ISO certified to ensure compliance with industry standards.

- Pricing:

AccountsIQ offers three plans based on your company’s needs. These are the Essential Plan which starts at £199/month, the Growth Plan, which starts at £450/month, and the Enterprise Plan, which is available by quote only.

Serenic navigator

Serenic Navigator Dashboard

Serenic Navigator is part of the Microsoft Cloud that provides ERP solutions to nonprofits, for-profit organizations, K-12 schools and local governments. Since it is powered by Microsoft Dynamics 365 Business Central, it provides easy and unlimited access and integration with other Microsoft Office applications such as MS Word, Excel, and Outlook. It also offers additional services.Invest in the best accounting software for your company.

Keeping up with the times is crucial when it comes to finance and accounting, and it’s impossible to deny that as technologies become more advanced, so will accounting services that rely on machines, software, and apps. will be done to ensure that the correct number is reduced and that manual, labor-intensive tasks are reduced.

The cost of digitization comes at a high price, but most of the examples of accounting software mentioned above result in efficiency and a great return on investment. In addition, accounting software providers offer a range of prices that are affordable and customized for every type of client, whether you are a freelancer, accountant, small shop owner, store manager, or a large company. I am the franchise executive. . . In addition, free trials are also widely available so that you can test their products and see which software suits your needs.

In this modern age of computers, business owners aren’t the only ones who may need these solutions. Almost every sector may need a public financial management system to help them manage their finances and conserve other resources.

While the solutions on this accounting software list aren’t inherently meant to eliminate and replace certain professions immediately, they can certainly be a huge help if redundancies and processes can be relegated to other avenues. I should optimize the allocation of time, money and effort. . This can further benefit companies.

Best for advanced features: Zero

Why we chose it: Xero’s basic plan is limited, but higher-end plans provide many advanced features for a reasonable monthly price.

PROS

- Offers many educational resources for setup and use.

- Provides a lot of functionality with a mid-tier plan.

CONS

- There are invoicing and billing limits with the basic plan.

- There is no live customer support.

- Xero was founded in New Zealand but is quickly gaining popularity in the U.S. It offers three monthly plans and an additional payroll option. With the Starter plan, you can only enter 20 receipts and five bills per month. Depending on your business, the initial plan may be very limited.

If you choose the Growing or Established plans, you get unlimited invoicing and bill entry. A growing plan can offer enough functionality for many small businesses even as the business expands. However, the established plan has some advanced features not found with many other solutions, including employee expense claims management, project tracking and in-depth analytics.

Xero provides support for both setting up and using the platform and offers several classes to help you learn more about the platform’s many features. However, it doesn’t have live customer support, so you’ll be limited to chat or email communication if you have issues or questions.

- Zero Plan Price:

- Beginner: $12/month.

- Growing: $34/month.

- Established: $65/mo

- The highlights

Prominent features

- Consolidate bulk transactions, easily access bills and receipts, monitor your short-term cash flow

- Customer service

- Email support for setup and usage

- Additional benefits

- Payroll add-on, 30-day free trial

- Our partner

- To start

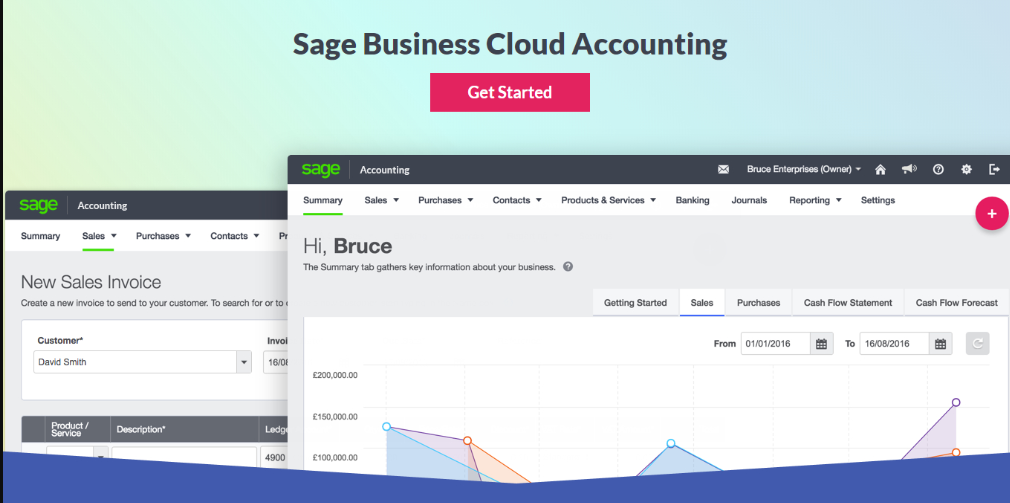

Best for basic accounting: Sage Business Cloud Accounting

Why we chose it: Sage’s Basic plan doesn’t offer a lot of bells and whistles, but it’s affordable and offers several ways to easily access its customer support, as well as get you up and running. Provides many resources for Platform

PROS

- No credit card required for 30-day free trial.

- Exceptional customer support

CONS

- Some features compared to other packages

- Paid add-ons are required to scale functionality.

- Sage Business Cloud Accounting is a cloud-based accounting software for small businesses with two plan options. The Sage Accounting plan supports unlimited users who can access the platform from anywhere for just $25 per month. The Sage Accounting Start Plan supports only one user and may be better for solopreneurs.

If you want to scale Sage as your business grows, you may need to pay for some of the many available add-ons for payroll, inventory, reporting, and more.

Sage provides more customer support options — phone, email or online chat — and knowledge resources than any other leading accounting solution. Sage also provides instructor-led courses, webinars and drop-in Q&A sessions and hosts an online community for asking questions and solving problems.

- Sage Plan Pricing:

- Sage Accounting Starts: $10/month.

- Sage Accounting: $25/month.

- The highlights

- Prominent features

- Get cash flow forecasting, automatically reconcile bank transactions, manage purchase receipts.

- Customer service

- Exceptional support and educational resources

- Additional benefits

- Sage Accounting Plan offers 70% off six months, 30-day free trial, many add-ons.

- To start

Best for freelancers and micro-businesses: Clear

Why we chose it: Users report that Neat is easy to use, which frees up time spent on bookkeeping — time you could use to generate more income — that freelancers Our top choice for the best accounting software for

PROS

- Offers an affordable annual customer support plan.

- Document search feature.

CONS

- Invoicing and reporting is included as an add-on.

- Does not offer a monthly payment plan.

- Saaf is unique in that it offers only one plan, which must be paid in full on an annual basis. It does not have a monthly payment plan. Plus, it may lack some essential functionality if you don’t get the Automatic Insights add-on for an additional $150 per year. This add-on includes many of the platform’s invoicing and reporting features.

Neat’s base plan comes with unlimited email and chat support and access to its help center knowledge base. If you also want unlimited phone support, you’ll need to purchase VIP service for an additional $50 per year, and you can schedule one-on-one training. That $50 could be well spent.

Paying an average of $33 per month annually for all three of Neat’s components is less expensive than other providers’ monthly plans.

- Clean Plan Price:

- $200/year.

- The highlights

- Prominent features

- Get unlimited file storage, use the mobile app to link receipts with expenses, schedule bill payments

- Customer service

- Unlimited chat and email support, phone support is only available as a paid add-on.

- Additional benefits

- 14-day free trial, VIP service for $50/year.

Other Small Business Accounting Software We Considered

We researched several accounting software solutions to determine the best for each category. The following solutions don’t have features that surpass the top seven and therefore didn’t make the cut for the best small business accounting software. However, they may be worth considering depending on the size and budget of your business.

Cashew

If you want a straightforward small business accounting software solution, Kashoo claims to be the world’s simplest accounting software for “truly small” businesses. You can use its invoicing plan for free and its accounting plan for just $20 per month.

PROS

- Offers a free plan that only tracks income.

- It has an easy-to-use interface.

CONS

- Does not provide document management functionality.

- Allows multiple users only with the Advanced Accounting plan.

Zip boxes

ZipBooks is a simple accounting software for a small business just starting out. It has a free plan that provides basic invoicing, vendor and client management and digital payment processing through PayPal or Square. For $15 per month, you can automate most of your invoicing.

PROS

- Provides business insights based on your data.

- Considered easy to learn.

CONS

- Offers fewer features per tier than many other solutions.

- Reporting functionality is limited.

Landew

- Lendio lacks accounts receivable and payable functionality and may work best as a micro-business accounting software solution or for freelancers. However, Lendio has a free plan with payment processing functionality for a reasonable per-transaction fee.

PROS

- Supports pricing and estimates.

- Receives excellent customer service ratings.

CONS

- Some features are not supported on the mobile app.

- Lacks some of the accounting features of other platforms.

Best Accounting Software for Small Business

You’ve probably done a lot of research on how to start a small business and what steps you need to take if you want to succeed. If you’re a new small business owner or have never needed to use an accounting solution before, you may find the many available plans and features overwhelming. This quick guide can give you a better understanding of what accounting software can provide and what you should look for in an accounting solution.

What is accounting software?

At its most basic, accounting software are computer programs that allow you to manage your business’s income and expenses. However, most of today’s software packages go beyond general ledger entries. Many let you perform accounting tasks like paying employees, billing clients, tracking inventory and even paying utilities, all with one software system.

How does accounting software work?

There are many types of accounting software, from simple desktop spreadsheet-based programs to feature-rich cloud-based platforms. Most let you link your business bank accounts and credit cards to the software and import your banking transactions instead of manual data entry.

You can usually perform tasks such as categorizing expenses and preparing invoices and reports with little effort. Accounting software enables you to automate much of the accounting process, so you have more time to focus on other aspects of your business.

How to Choose an Accounting Tool

While it’s possible to find free basic invoicing software and bookkeeping apps to help you manage your business finances, these free small business tools will likely outgrow your accounting as your business grows. Will not meet the requirements. They also won’t have much of the time-saving automation functionality that most accounting software has.

Choosing an accounting solution that will meet your accounting needs now and later will help you keep your business finances on track and save you time that can be better spent growing your business. can be spent.

Accounting software solutions vary significantly in pricing and features. Sorting through and comparing the many options can seem overwhelming. Paying attention to the following criteria can help make the process easier.

Calculate your budget and look at prices

First, determine how much you can afford to spend on an accounting solution each month. As you consider plans and pricing, don’t discount a software solution on price alone. Spending a little more money can provide tools that can save you a lot of time.

What is your total number of users?

Many basic accounting plans only allow one or two users with their own unique login. However, many small businesses today work with two or more people, often from different locations, to handle the accounting needs of the business.

If you have a bookkeeper, virtual assistant or accountant who will need access, consider your needs. To support multiple users you need .

- Bottom line: Xero is our favorite accounting service for small businesses. With free unlimited users, it’s a great choice for collaborative businesses like multi-partner LLCs. Its low starting price and great app also make it perfect for freelancers, contractors, and other sole proprietors.

- Not interested in Xero? FreshBooks is a good alternative for business owners who want unlimited invoices. QuickBooks works well for online business owners who value solid reporting and tax tracking, and Zoho Books affordably automates important tasks that can waste business owners’ time. Finally, Wave Accounting is a good free accounting option for budget-conscious freelancers and small business owners.

- If you own a business, you need accounting software to properly manage the financial health of your business. Of course, the software you choose needs to be directly related to the size and scope of your business. There are more accounting software choices available than ever before, all with different price points to fit any budget. So, no more excuses. It’s time to find the right product for you.

- If you’re looking for small business accounting software, you have no shortage of choices.

- While this is great, it can also be confusing. To reduce confusion and have a better idea of what you’re looking for, it’s best to decide what features you need and work from there.

- Our top ten applications range from simple accounting software designed for sole practitioners to feature-laden applications that grow with your business.

| PRODUCT | DESCRIPTION | NEXT STEPS |

| FreshBooks offers invoicing, time and expense tracking, simple project management and a wide range of general accounting applications all in one easy-to-use desktop and mobile interface. | Learn Morefor FreshBooks | |

| Zoho Books is an affordable entry-level accounting application with features to automate workflows and track expenses and a client portal that lets you share estimates and invoices with customers. | Read Review | |

| QuickBooks Desktop remains a favorite among small business owners. Read our review of this popular small business accounting application to see why. | Read Review | |

| AccountEdge Pro has all the accounting features a growing business needs, combining the reliability of a desktop application with the flexibility of a mobile app for those needing on-the-go access. | Read Review | |

| Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. | Learn Morefor Sage 50cloud Accounting | |

| AccountingSuite is an excellent accounting software application best suited for small businesses looking for good inventory management capability. | Read Review | |

| With full-featured accounting, invoicing, CRM, and inventory management capability, OneUp does the work of several applications, all wrapped up in one affordable software package | Read Review | |

| Xero is an online accounting solution with apps for invoicing, expense management, inventory management, project management, and bill payment. It includes a mobile app and supports unlimited users. | Read Review | |

| Sage Business Cloud Accounting is a good fit for sole proprietors and freelancers. It uses double-entry accounting and includes tools for tracking sales, expenses, contacts, banking, and reporting. | Learn Morefor Sage Business Cloud Accounting | |

| QuickBooks Online is the browser-based version of the popular desktop accounting application. It has extensive reporting functions, multi-user plans (for up to 25 users) and an intuitive interface. | Learn Morefor QuickBooks Online | |

| Kashoo is a small business accounting application that combines invoices, banking and credit accounts all into one inbox for simple, one-click invoicing and bill payment. | Read Review | |

| GnuCash is an open-source accounting software that’s also used to manage personal finances. It features double entry accounting, a checkbook-style register and tools for account reconciliation. | Read Review | |

| f you’re a small business owner looking for an easy to use, free accounting software application, be sure to check out ZipBooks, an online application that offers a free plan. | Read Review | |

| Wave helps small businesses and freelancers manage double-entry accounting. It features a simple UI and applications for payroll and online payments and includes 2 months of free chat support. | Read Review |

- The best financial software for small businesses

- QuickBooks: Preferred Partner

- Zero: The Best Total Accounting Software

- Fresh Books: Best Invoicing

- Zoho Books: Best Features

- Lahar: Budget choice

- Our most user-friendly accounting software: Quickbooks

- If you’re looking for accounting software that’s user-friendly, packed with smart features, and scales with your business, Quickbooks is a great option.

- Zoho Books is the most comprehensive accounting software.

- Classification Procedures

- Fresh books

- Learn more about FreshBooks.

- Logo for FreshBooks

- Rating Image, 4.60 out of 5 stars.

- 4.60 stars.

- Our ratings are based on a 5-star scale. 5 stars equals excellent. 4 stars are the best. 3 stars equals good. 2 stars equals fair. 1 star equals poor.

- Bottom Line: FreshBooks offers a wide range of invoicing, time and expense tracking, simple project management and general accounting applications all in one easy-to-use desktop andmobile interface. Read the full review.

FreshBooks

FreshBooks is an online accounting software application that works well for sole proprietors and freelancers.

The Retainers feature in FreshBooks also makes it ideal for attorneys, accountants, or any other professional who charges retainer fees to their clients.

Offering a solo version and a team version, you can easily connect with other employees or contractors you work with.

New features in FreshBooks include the ability to automatically capture receipt data, eliminating the need to manually enter information. Users can now pause and resume the timer later when recording time for any project. Finally, if you work with an accountant, FreshBooks recently introduced the FreshBooks Accounting Partner Program, making it easy to share data with your accountant or CPA.

Freshbooks also offers ACH payment acceptance, solid invoicing capabilities, and the ability to create and manage projects.

FreshBooks provides an overview of all unbilled time to ensure clients are billed correctly.

FreshBooks provides an overview of all unbilled time to ensure clients are billed correctly. Image source: FreshBooks.

You can also create estimates and proposals in FreshBooks, and link the application to your bank accounts for easy expense management.

FreshBooks doesn’t offer payroll, although it integrates with Gusto Payroll if you have employees to pay. FreshBooks also offers a mobile app for both iOS and Android devices.

FreshBooks offers four plans: Lite, Plus, Premium, and Select. The Lite plan is suitable if you are self-employed, while the Premium plan is suitable for small businesses. FreshBooks Lite runs $15 a month, Plus is $25, and Premium is $50, with a 70% discount for the first three months. Custom pricing options are available from the company.

Perhaps the biggest benefit of using FreshBooks is that you’ll actually use it. Many freelancers and self-employed people may be stubbornly attached to using spreadsheets to manage their business finances, but FreshBooks is so easy to use that you’ll happily ditch your spreadsheets.

Offering just enough features for small businesses without saddling you with a bunch you’ll never use, but have to pay for, FreshBooks is worth the minimal investment.

Zoho Books

- Read the review

- Logo for Zoho Books

- Rating Image, 4.50 out of 5 stars.

- 4.50 stars.

- Our ratings are based on a 5-star scale. 5 stars equals excellent. 4 stars are the best. 3 stars equals good. 2 stars equals fair. 1 star equals poor.

- Bottom Line: Zoho Books is an affordable entry-level accounting application with features to automate workflow and track expenses and a client portal that lets you share estimates and invoices with customers. Read the full review

- If you’re a sole proprietor, freelancer, or starting a brand new business, Zoho Books is for you.

- Affordable even for the tightest budgets, Zoho Books includes a solid inventory management feature and provides new users with step-by-step instructions for everything from general setup to writing invoices, setting up your new business. It becomes easier to give and go faster.

Zoho Books offers a long list of features, though most are in the Professional plan. These features include automated workflows, better expense tracking, recurring transactions, project management, and the ability to create custom invoices. New to Zoho Books, users can add tax preferences directly to existing customers and vendors. Users can now save custom reports to the system for future use, and a new bank account overview has been added.Zoho Books starting page with a tutorial video and setting up tips.Zoho Overview takes new users step-by-step through the setup process. Image source: Zoho Books.

A client portal is available that allows you to share receipts with your customers, and has been updated to allow customers to sign up from the portal itself. Zoho Books includes an accountant version that lets you share your business details with your CPA or accountant.

Zoho Books also offers convenient online payment options for your customers, a mobile.

The most comprehensive

- Zoho

- 4.1 out of 5 stars

- 4.1

- Starting at $0.00/month.*

- Professor

- Average initial cost paid ($10.00/mo. billed annually)

- Professor

- Additional users $2.50 per user/month.

- Professor

- Automatic recurring invoice

- View plans

- Data as of 11/4/22. Offers and availability may vary by location and are subject to change.

- *Only available to businesses with annual revenue of <$50K USD. Paid plans start at $15.00 per month when billed annually.

Zoho Books automates the most common (and, let’s face it, boring) bookkeeping tasks—which means more time for your business and customers and less time for tedious data entry. Specifically, it lets you set up automatic customer payment reminders, create recurring expense profiles, and manage 1099 contractors.

Also, Zoho Books is only one piece of software in the larger suite of Zoho products. Each Zoho product integrates easily with the rest, which means that along with accounting, you can use Zoho for project management, inventory management, and customer relationship management (CRM).

Here’s the best part: If you earn less than $50K a year, you can take advantage of Zoho Books’ free plan. Otherwise, Zoho Books starts at $15 a month if you pay annually or $20 if you pay monthly. The cheapest plan includes three users, but you can pay an additional $2.50 per month for each additional user. That’s a fantastic deal, especially compared to FreshBooks’ extra $10 per user per month. Zoho also offers discounts to nonprofits—one reason it’s among our top financial management software picks for nonprofits that need real fund accounting.

Unfortunately, while it’s a solid accounting tool, Zoho Books has one major flaw: Zoho doesn’t offer payroll plan integration unless you live in California, Texas, or India. And it doesn’t integrate with third-party payroll providers either. Instead, you have to manually update the payroll-related aspects of your books, which greatly reduces Zoho’s core automation perk.

Similarly, Zoho Books’ cheapest plan does not include automatic journal entry creation. Instead, you must manually create an entry each time you debit or credit an account. If you log more than a few transactions a month, the lack of automation is too much time and hassle—you’ll want the $40 per month (or $50, billed monthly) Professional plan instead.

Pros:

- Pro Free Plan Option

- Excellent integration with other Zoho apps

- Affordable monthly fees for additional users

Cons

- conNo payroll integration

- Manual journal entries only with cheaper plans

- Check out Zoho’s accounting plans

- Read our Zoho Books review

- Xero is the best overall accounting software.

- Overall excellent

- zero

- 4.2 out of 5 stars

- 4.2

- Starting at $13.00/mo.

- Professor

- Low starting price

- Professor

- Unlimited users with each plan

- Professor

- Inventory management with each project

- Data as of 11/29/22. Offers and availability may vary by location and are subject to change.

Xero

We like Xero for its strong features and low price. For just $13 a month, Xero lets you send custom invoices, reconcile bank transactions, receive invoices for easy record keeping, and track inventory.

But as a small business accounting tool, Xero really stands out on the collaboration front. Unlike almost every other accounting solution (including QuickBooks and FreshBooks), all of Xero’s accounting and inventory software plans include unlimited users. You don’t need to pay extra to delegate responsibilities such as bank reconciliation or tracking expenses to another team member: time-saving support is included in your price.

However, Xero’s $13 monthly plan limits you to entering just five bills and sending just 20 invoices a month. You can send unlimited invoices and quotes with the Grove and Established plans only, which start at $37 and $70 per month, respectively. Also, you can only track expenses with the premium plan. In contrast, both QuickBooks and FreshBooks offer small business expenses up front.

Pros:

- Free unlimited users

- Affordable accounting software

- Pro user friendly software

- Pro integration with 1000+ third party apps

Cons

- Cost tracking with only the most expensive plan

- conPlan Limited Invoicing

- Check out Zero’s plans

- Read our Zero review

- QuickBooks Online is the most user-friendly accounting software.

- Most user friendly

- Instant books.

- 3.9 out of 5 stars

- 3.9

- Starting at $15.00/month.*

- Professor

- Advanced accounting features and reporting

- Professor

- Up to 25 users (depending on plan)

- Professor

- Unlimited expense and sales tax tracking with every plan

- View plans

Data as of 11/29/22. Offers and availability may vary by location and are subject to change.

*30-day free trial or 50% off for three months. Price goes up to $30/mo. After the promotional period.

- Wave is the most affordable accounting software.

- Most affordable

- the wave

- 3.6 out of 5 stars

- 3.6

- Free for life

- Prof

- Free accounting software for life

- Prof

- Unlimited users

- Prof

- Keeping track of income and expenses

- Read the review

- Data as of 11/29/22. Offers and availability may vary by location and are subject to change.

- For exactly $0, Wave offers you a smart, user-friendly dashboard and a host of features that rival paid accounting systems. For example, View Accounting includes multi-currency support, expense tracking, unlimited invoicing, unlimited bank account connections and double-entry accounting — a more accurate method of accounting that FreshBooks’ basic business accounting plan lacks.

- Wave also allows you to run multiple businesses with a single account. If you’re an Amazon or eBay seller who also manages a small team of contractors, you can track both sets of finances without paying anything.

- While Wave has a useful payroll tool, its accounting software isn’t necessary for a business with dozens of employees. Because Wave only offers one accounting plan, businesses cannot upgrade to plans that include more accounting functions for a growing business. And Wave’s lack of inventory tracking makes it better suited to service-oriented solopreneurs and freelancers who don’t need both accounting and inventory software.

Pros:

- Free for life

- Pro accounting, invoicing, and payment acceptance

- Multi-business management with one account

Cons

- Limited features compared to competitors’ paid plans

- Limited payroll integration

- Read our View Review

- Accounting software deserves an honorable mention.

- Not sold on our top picks? Here are five more small business accounting software options that may work best for you.

- Sage Accounting: Best User Experience Runner-Up

- OneUp: Perfect for sales teams

- Cashew: The easiest setup

- Zip Boxes: Most Affordable Runner Up

- Sage Business Cloud Accounting: Best User Experience Runner-Up

- Excellent user experience

- Dad

- 3.9 out of 5 stars

- 3.9

- Starting at $10.00/mo.

- Prof

- Low starting price

- Prof

- Unlimited users ($25.00/mo. plan only)

- Prof

- Automatic bank reconciliation

- View plans

- Data as of 11/29/22. Offers and availability may vary by location and are subject to change.

- The cheapest Sage Business Cloud Accounting plan lets you generate invoices, track dues, and automatically reconcile your bank accounts. If you’re willing to pay a bit more ($25 a month), Sage Accounting adds unlimited users, pricing, estimates, cash flow forecasting, and purchase invoice management.

- Unfortunately, Sage charges extra for receipt scanning, a feature competitors like Wave, FreshBooks, Xero, and QuickBooks include for free. And Sage’s pricier plan has more built-in features than Xero’s cheapest plan. (On the other hand, Sage’s accounting system does not limit your monthly invoice amount).

- If you’re looking for industry-specific accounting software, Sage has some standout solutions beyond Sage Business Cloud Accounting. For example, Sage 100 Contractor is a preferred accounting option for professionals in the construction business. And Sage Intacct is one of the best accounting services for nonprofits.

Megaphone

Sage Accounting Exemption

Sage Business Cloud is currently offering new customers a 70% discount on the first six months of Sage Accounting — normally priced at $25 per month. With the discount, your price drops to $7.50 for six months. If you’re considering Sage, we recommend taking advantage of the discount to save over $100.

- See Sage’s accounting plans

- Read our sage review

- OneUp: Perfect for sales teams

- Perfect for sales teams

- A step up

- A step up

- Starting at $9.00/mo.

- Prof

- Low starting price

- Prof

- Limited users of the plan

- Prof

- Unlimited receipts

- View plans

- Data as of 11/29/22. Offers and availability may vary by location and are subject to change.

- All OneUp plans include customer relationship management (CRM) features, making it perfect for sales teams that frequently follow up with customers. Plus, it’s affordable: pricing starts at $9 per month for a single user. If you’re a Mac user, though, you’re out of luck: OneUp only works for Windows users. And while every OneUp plan includes all of OneUp’s features, its plans limit the number of users you can have. Only the most expensive plan, which starts at $169 a month, includes unlimited users.

- Check out OneUp’s plans

- Cashew: The easiest setup

- Easiest setup

- Cashew

- Cashew

- Starting at $0.00/mo.

- Prof

- Free plan with good features

- Prof

- Additional user options

- Prof

- Keeping track of income, expenses and sales tax

- View plans

- Data as of 11/29/22. Offers and availability may vary by location and are subject to change.

- One minute left? You can set up Casho in 60 seconds or so, and the app immediately starts classifying your expenses and learning your business spending habits. Like Zoho Books, Kashoo’s automation is its selling point—and unlike Zoho Books, it integrates with SurePayroll, one of our top payroll providers.

- Kashoo’s accounting software starts at $20 per month. If you’re looking for a cheaper solution, Casho offers an invoice-based plan for $0.00. In addition to sending invoices, you can use the free plan to track expenses, accept online payments, and send estimates. We’re not sure if the free plan lets you track income and expenses—Kasho’s site gives conflicting answers.

- Either way, though, it looks like Kashoo is planning to add expense and income tracking to its free plan, if it doesn’t already include those two features.

- See Cashew’s Accounting Plans

- Zip Boxes: Most Affordable Runner Up

- Cheapest alternative

- Zip boxes

- Zip boxes

- 2.6 out of 5 stars

- Prof

- Low starting price

- Access to a user plus an accountant

- Prof

- Unlimited invoices, billable clients, and vendors

- View plans

- Data as of 11/29/22. Offers and availability may vary by location and are subject to change.

- If you don’t need as many features as Wave offers, ZipBooks is a solid free accounting software alternative. Although it’s free, it doesn’t limit the number of invoices you can send (like Xero) or the clients you can bill each month (like FreshBooks) — you can access unlimited custom invoices. And can also accept payments. ZipBooks’ paid plan starts at $15 a month and offers better bookkeeping and automation features than its free accounting plan. But if you prefer your accounting tools on the go, look elsewhere. ZipBooks’ iOS app has disappeared from the App Store, and it never had a Google Play app worth mentioning.

QuickBooks Desktop

- Read the review

- Logo for QuickBooks Desktop

- Rating Image, 4.50 out of 5 stars.

- 4.50 stars.

- Our ratings are based on a 5-star scale. 5 stars equals excellent. 4 stars are the best. 3 stars equals good. 2 stars equals fair. 1 star equals poor.

- Bottom Line: QuickBooks Desktop is a favorite among small business owners. Read our review of this popular small business accounting application to find out why. Read the full review

- QuickBooks Desktop 2022 includes several new features designed to streamline various processes. These new features include:

- Payment of due bill

- Automatic Bill Enrollment using mobile app

- Ability to attach documents via mobile device

- Up to 38% faster than previous versions

- In addition, all QuickBooks editions offer the following features:

- Invoicing

- QuickBooks Desktop offers advanced invoicing software capabilities, allowing users to create professional invoices for their customers. The Premier Edition offers users a variety of industry-specific invoice templates including professional, product, and service invoice templates.

- You also have the option of using QuickBooks Payments to get paid faster, including the ability to add a “Pay Now” button to customer invoices for easy payment.

- Inventory

- Good inventory tracking capabilities are available in all QuickBooks Desktop editions, with the ability to track all products sold, cost of goods sold, and inventory management, including inventory adjustments.

- QuickBooks desktop screen for adding an inventory item with form fields for sales and purchase information.

- You can easily add inventory items to QuickBooks Desktop, with custom fields available to track additional details. Image source: QuickBooks

- The Premier Edition’s inventory module offers more advanced inventory features, including low stock alerts, the ability to track any product by manufacturer part number, the option to add product cost, and the ability to reset points. . In addition, there are custom fields that can be used to track additional information for any inventory item.

- QuickBooks Desktop pricing starts at $349.99/year for Pro Plus 2022, with Premier Plus running at $549.99/year, and Enterprise comes in at $1,206/year, with special pricing for the first year.

- Account Edge Pro

- Read the review

- Logo for AccountEdge Pro

- Rating Image, 4.70 out of 5 stars.

- 4.70 stars.

- Our ratings are based on a 5-star scale. 5 stars equals excellent. 4 stars are the best. 3 stars equals good. 2 stars equals fair. 1 star equals poor.

- Bottom Line: AccountEdge Pro has all the accounting features that growing businesses need, combining the reliability of a desktop application with the flexibility of a mobile app for those who need access on the go. . Read the full review

- AccountEdge Pro has the honor of being our top-rated accounting application, and for good reason.

- Perfect for small and growing businesses, AccountEdge Pro is an on-premise application that gives you easy-to-use remote access to the entire accounting cycle. A hosted version of AccountEdge Pro is also available for those who need anytime / anywhere access to the application.

- Easy integrations with Shopify and UPS Shipping make AccountEdge Pro particularly suitable for online retailers, as does the recently added integration with Square, allowing you to import Square transactions directly into AccountEdge Pro. Is.

- AccountEdge Pro offers solid invoicing capabilities with excellent time and billing functionality that can track both billable and non-billable hours. Self-service and full-service payroll are also available, and a solid inventory module lets you easily manage your stock. AccountEdge Pro recently added an automatic bank feed option, allowing you to link both bank and credit card accounts to the application. A $5 subscription fee is required to use the bank feed option.

- Account Edge Pro Invoice Builder with standard fields for creating invoices.

- AccountEdge Pro offers advanced invoicing capabilities for small and growing businesses. Image source: AccountEdge Pro

- As an added bonus, AccountEdge Pro also includes a contact feature to track customers, vendors and employees using a single database. And with the new integration with Zapier, AccountEdge Pro can now connect with thousands of web apps.

- Account Edge Pro has excellent reporting options, including an audit trail report. A mobile app is also available for both iOS and Android devices.

- AccountEdge Pro offers two plans: AccountEdge Pro and Priority ERP. Pricing for Pro is a la carte style, with a single user license starting at $15/month, with additional licenses at $10/month. Payroll subscription is $15/month, with phone support also costing $15/month. Pricing for Preferred ERP is customized for each company.

Sage 50 Cloud Accounting

- Learn more about Sage 50 Cloud Accounting.

- Logo for Sage 50 Cloud Accounting

- Rating Image, 4.50 out of 5 stars.

- 4.50 stars.

- Our ratings are based on a 5-star scale. 5 stars equals excellent. 4 stars are the best. 3 stars equals good. 2 stars equals fair. 1 star equals poor.

- Bottom Line: Sage50 Cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing, and vendor, customer and employee management. Read the full review

- Formerly known as Peachtree Software, Sage 50cloud Accounting is a hybrid solution that is installed on-premise, but also includes the option to connect to the application remotely if needed.

- Sage 50 Cloud Accounting is a good choice for small and growing businesses, with multiple plans available. Sage 50 Cloud Accounting includes a solid inventory module and offers integration with multiple point-of-sale (POS) applications, making it particularly suitable for retailers.

- Sage 50 Cloud Accounting Vendor Management screen with shortcuts to get started and a list of vendors.

- Sage 50 Cloud Accounting offers excellent vendor management capabilities. Image Source: Sage 50 Cloud Accounting

- Sage 50 Cloud Accounting allows you to connect your bank accounts or track your business expenses in a more traditional way. The application also includes excellent customer management and sales management, including the ability to accept online payments. You also have the option of paying your vendors electronically, or by printing a check for mailing.

- The inventory module in Sage 50 Cloud Accounting includes multiple pricing tiers with user-defined fields to track additional information. Two payroll options, Essential and Full Service, are available, and reporting options are advanced.

- Sage 50 Cloud Accounting also includes a mobile app for both iOS and Android devices.

- Sage 50 Cloud Accounting offers three plans: Pro, Premium, and Quantum, with annual pricing starting at $340 for the Pro plan. The Premium plan, which most small businesses will likely benefit from, costs $554/year, while Quantum runs $919/year. All pricing is for a single user system, with additional users.

- A scalable application with three plans available, Sage 50 Cloud Accounting can be beneficial for growing businesses.

- Integration with Microsoft 365 provides easy online access, and access to POS and inventory features makes this application particularly useful for brick-and-mortar retailers as well as those who sell products online.

- Accounting suite

- Read the review

- Logo for AccountingSuite

- Rating Image, 4.40 out of 5 stars.

- 4.40 stars.

- Our ratings are based on a 5-star scale. 5 stars equals excellent. 4 stars are the best. 3 stars equals good. 2 stars equals fair. 1 star equals poor.

- Bottom Line: AccountingSuite is an excellent accounting software application for small businesses looking for excellent inventory management capabilities. Read the full review

- AccountingSuite offers the features small businesses expect from any software application, including cloud access and solid accounting capabilities. The accounting suite also offers bank connectivity, connecting to more than 9,000 financial institutions through this application.

- You can manage your invoicing in the Sales module, and pay and process bills in the Purchases module. The application offers both project and time tracking capabilities, so you can track projects and profitability, while the time tracking feature allows you to record the time spent on each individual project.

- But AccountingSuite also has some outstanding features that aren’t always available in small business accounting software.

Budgeting

- Not all small businesses need a budgeting tool, but if you can get one with your software application, why not take advantage of it? AccountingSuite offers an incredibly robust budgeting tool that lets you create budgets for every account in your general ledger.

- The budget tool lets you create a budget for the current fiscal year or any future year, and you can choose the types of accounts you want to include in the budget.

- A screenshot of the accounting suite with the new budgeting option and chart of accounts shown.

- AccountingSuite offers easy budget creation with quick access to your chart of accounts. Image source: AccountingSuite.

- There is also a pre-fill option, which can be used to automatically pre-fill the budget with actual data from the application or an imported file. If you want to see how close you are to budget, run the Budget Report, which calculates actual income and expenses and compares actuals to budgeted totals.

- AccountingSuite offers four plans. Its Startup plan supports a single user, and runs $19/month. Also available are the Business plan, which supports two users for $25/month, and the Professional plan, which supports up to five users.

- QuickBooks Online

- Learn more about QuickBooks Online.

- Logo for QuickBooks Online

- Rating Image, 4.20 out of 5 stars.

- 4.20 stars.

- Our ratings are based on a 5-star scale. 5 stars equals excellent. 4 stars are the best. 3 stars equals good. 2 stars equals fair. 1 star equals poor.

- Bottom Line: QuickBooks Online is a browser-based version of the popular desktop accounting application. It has extensive reporting functions, multi-user plans (up to 25 users) and an intuitive interface. Read the full review

- QuickBooks Online is probably the most recognized of all small business accounting applications. Designed specifically for small businesses, QuickBooks Online provides easy anytime/anywhere access that their more robust desktop versions lacked.

Quick books

- Perfect for small and growing businesses, QuickBooks Online is often compared to FreshBooks. It integrates with hundreds of third-party applications, making the application suitable for all types of businesses.

- QuickBooks Online features vary widely from plan to plan, with many of the more robust features found only in the more expensive plans.

- Features available on all plans include online banking connectivity, including now the ability to connect to third-party payment processing applications such as PayPal and Square. QuickBooks Online includes a nice expense management feature along with receipt capture capability for generating expense reports.

- QuickBooks Online displays expense reports detailing date, type, number, payee, etc.

- QuickBooks offers easy online expense management, including multiple bill payment options. Image source: Intuit QuickBooks Online.

- Excellent sales tracking and inventory management capabilities are also available, and you can easily download the mobile app for both iOS and Android devices.

- QuickBooks Online does not include payroll, but does include the option to add Intuit Payroll Services directly to your existing plan.

- In addition, QuickBooks also offers integration with other third-party payroll applications.

- QuickBooks Online pricing can be confusing, with posted prices reflecting introductory discounts, and regular prices kick in after the first three months. Pricing starts at $15/month for the Simple Starter plan for one user, rising to $30/month after three months.

- Other plans include Essential, which supports up to three users and starts at $27.50/month, then increases to $55/month. Plus, which is designed for five users and runs $42.50 per month for the first three months and then doubles to $85. and the Advanced plan, which can handle up to 25 users and starts at $100/month, rising to $200/month after three months.

- One of the biggest benefits of using QuickBooks Online is its integration with hundreds of apps in multiple categories including payroll, inventory, HR, and project management.

Cashew

- Read the review

- Logos for Cashew

- Rating Image, 4.10 out of 5 stars.

- 4.10 stars.

- Our ratings are based on a 5-star scale. 5 stars equals excellent. 4 stars are the best. 3 stars equals good. 2 stars equals fair. 1 star equals poor.

- The Bottom Line: Casho is a small business accounting application that combines invoice, banking and credit accounts into one inbox for simple, one-click invoicing and bill payment. Read the full review

- Originally designed for consultants, sole proprietors, and freelancers, Casho continues to offer good bookkeeping basics with extensive options that make it ideal for consultants looking for an invoicing solution for small businesses that require accounting. Looking for a complete solution.

- Casho offers integration with SurePayroll for those who need to pay employees, although you may want to consider a more robust application if you need to pay more than a few employees. Kashoo offers a smooth user interface, which makes it easy to navigate, even for less tech-savvy users.

- Casho offers easy invoicing, with the ability to add credit card payments to any invoice for quick payment. You can also create recurring invoices for customers who are billed a fixed amount each month.

- Kashoo’s new inbox feature.

- Kashoo’s new inbox feature provides access to all current tasks. Image Source: Kashoo.

- Casho lets you track incoming bills, with the option to pay vendors electronically, though there is no option to process checks for payment.

- The list feature lets you manage all your customers and vendors, and the add-ons area gives you easy access to any third-party applications you’ve connected to Kashoo.

- The application offers a mobile app for both iOS and Android devices that can be used in conjunction with its web app. It includes features like dashboards, expense capture and invoice upload, invoice creation and tracking, and payment acceptance.

- Kasho completely rethought his plans.

Who uses accounting software?

- I’d like to say that anyone in business uses accounting software, but unfortunately, that’s not the case. However, everyone in business should use accounting software. That includes the contractor you hired to write a press release, the property management company that you pay your rent to each month, your mortgage holder, your doctor, and your attorney. Everyone who is in business should be using some type of accounting software since it’s impossible to measure their company’s financial health without it.

Why use accounting software?

- Smart business owners use accounting software for a variety of reasons. Some use it because it simplifies the entire record-keeping process. Entering a customer into a software application and creating an invoice is much easier than entering that same information into a spreadsheet, and then having to create an invoice in another application. Others use it because they want to know how much money they’re making, or in some cases, not making. Still others use it to keep a better handle on their business expense categories.

- How will you know how healthy your business is if you have no idea who owes you money or how much money you’ve spent in the last six months? How will you convince a bank to give you a credit line if you can’t show them that your business is financially healthy? Perhaps most important, how will you keeptrack of your various tax obligations if you’re not adequately tracking sales tax, use tax, employment tax, and employee withholding tax?

- Below are some of the benefits of using accounting software.

- You’ll always know the financial status of your business

- Instead of consulting multiple files to see how much you’re spending, how much you’ve been paid, or how much is still owed, you can view all this information from one central dashboard.

- The QuickBooks Online dashboard provides all the details you need to stay on top of your business. Source: Intuit QuickBooks.

- This dashboard view from QuickBooks Online (above) gives you the information you need in one convenient location, including paid and outstanding invoices, where you’ve spent your money, and even the current balances of your bank accounts. So, stop looking at multiple spreadsheets and start using accounting software.

- It’s a faster way to get paid

- We all want to get paid, otherwise, there’s really no reason to be in business. But one of the ways to get paid faster is to make it easy for your customers to pay you. Accounting software helps with everything from including payment links in invoices to accepting electronic payments through your bank to accepting credit cards through a merchant account (see image below). Making it easier for them to pay a bill will likely mean that they’ll pay you faster, or at the very least, on time.

Taxes, taxes, taxes

- If you use accounting software for anything, use it to remain tax compliant. If you sell anything, you will owe taxes. If you pay employees, you will owe taxes. If you live in a large, metropolitan area, or sell in multiple states, you will owe taxes to several different agencies.

- QuickBooks Online offers easy sales tax setup in the application. Source: Intuit QuickBooks Online

- As the QuickBooks Online screen (above) asks, how often do you file sales tax? Using the appropriate accounting software will enable you to remain compliant with all tax agencies. You’ll be able to charge your customers the correct tax rate while also running reports that show how much tax is owed to each tax agency.

- If you have employees, you’ll have payroll taxes that need to be paid on time, such as federal withholding, state withholding, Social Security and Medicare taxes, and unemployment taxes. Let your accounting software do the heavy lifting and provide you with the tools you need to always be compliant.

- Your reports are accurate

- Transposition errors, extra decimals, decimals in the wrong place, extra zeros, not enough zeros; these are all things that can happen when you use spreadsheet programs to create reports manually. Professionally prepared reports give your business credibility. When you use accounting software, your reports are prepared using information you’ve already entered into the system. If that information is accurate, so are your reports.

- This report from Xero provides detailed sales tax information. Source: Xero.

- Microsoft Excel lovers shouldn’t feel too bad. Most accounting software applications allow you to export your reports to Excel, where you can customize them if you wish; the difference being that you’re starting with the correct numbers.

- What are the different types of accounting software?

- There are three types of accounting software applications that are commonly used.

- Commercial Accounting Software: These range from simple applications to full-service applications that offer bare-bones features that offer full accounting functionality. There are also a variety of add-on modules to choose from. Commercial software is usually available as a downloadable application delivered as a subscription as SaaS (software as a service) or from the cloud.

- Enterprise Resource Planning (ERP) software: These are generally used only by very large companies. ERP software is notoriously expensive, and unless you’re a billion-dollar company, it’s likely more than you need.

- Custom Accounting Software Applications: These were popular about twenty years ago, but have disappeared from most offices simply because the features available in commercial accounting software are now limited. Custom packages can also be more trouble than they’re worth and usually don’t integrate with other applications.

- Key accounting software functionality

- Accounting software applications should offer most, if not all, of the following features.

- Basic Accounting Features:

- Double entry accounting

- Invoicing (A/R)

- Bill Payment (A/P)

- Customer and vendor management

- Banking

- Budgeting

- Management reporting

- Additional modules:

- Inventory management

- Purchase orders

- Payroll

- Sales/Point of Sale

- You may not get every module in every product, but you should get the modules that are necessary to run your business.

Things to consider when buying accounting software

What features are most important to your business?

- Is easy invoicing important to you? Then you need an application that makes invoicing quick and painless. Do you offer a variety of products to your customers? If so, you need a way to properly manage your inventory. What about banking? Do you always forget to record your expenses when you use your credit card? If that’s you, you want an application that imports all your banking transactions, and records them in the appropriate expense account.

- If you have employees, you need a way to pay them, as well as to make sure your tax obligations are taken care of. While most accounting software does many, if not all, of these things, you need to decide which features are important to have, and look accordingly.

Your budget

- While it’s important to buy the accounting software that will work best for you, your organization’s budget considerations may also play a role in your final decision. If you are a sole proprietor or freelancer on a very tight budget, you may have to choose between applications that are within your reach. But don’t panic, many of the best applications available today are under $25 per month.

Your business location

- The type of business you run can play a role in your final decision, as can cost and features. If you sell hair products online, you will have different requirements than a graphic artist who provides a design service. But what if you sell products and services? Simply make sure the product you buy is suitable for both.

support

- While most people don’t think about support when comparing accounting applications, you can spend a few minutes looking at the available support options. I guarantee that there is nothing more frustrating than trying to figure out the answer to a problem without a good support structure. Knowledge bases are great, but they are no substitute for a real person.

- Accounting software is used by individuals and business owners to record income and expenses and track their finances. It is more efficient and makes fewer errors than manual processing. It can also save time with features like automation and it gives the owner a place to store important documents and receipts for anytime access. If accounting isn’t your strength or if it is and you want to save time, read on to see which accounting software is right for your business.

- To determine the best accounting software, we researched more than 20 programs and applications before deciding on the top eight. We’ve chosen them based on features and functionality designed specifically for small business owners, ease of use, cost, and more. Here are our top picks.

8 Best Accounting Software for 2022

- Best Overall: Fresh Books.

- Runner-up, Best Overall: Intuit QuickBooks

- Best for multiple users: Sage Business Cloud Accounting

- Best for experienced accountants: AccountEdge Pro

- Best Value: Wave Accounting

- Best Extra Features: Zero

- Best for e-commerce businesses: GoDaddy

- Best for Automation: Zoho Books

- Best Accounting Software

- Our top picks

- Fresh books

- Intuit QuickBooks

- Sage Business Cloud Accounting

- Account Edge Pro

- Wave accounting

- Zero

- Go Daddy

- Zoho Books

- See more (5)

- Frequently Asked Questions

- Procedures

- Excellent overall

- Fresh books

- Fresh books

- Sign up now

- Why we chose it

- FreshBooks uses cloud-based accounting and invoicing software that can be accessed through iPhone, Android, and iPad apps. It claims our top spot for best accounting software because it’s easy to use. Even business owners with little or no accounting experience can benefit from its robust features and helpful functions. It is also reasonably priced and can be used on the go.

FreshBooks features include:

- Payment reminders

- Recurring invoices with customization options including due dates and discounts

- Online credit card payments

- Multi-currency and language billing

- Automatic tax calculation for sales tax

- Tax Friendly Expenditure Categories

- Souvenir seller

- Time tracking with a Chrome browser extension

- Bank integration with bank deposits, recurring payments, and autobills

- Tax Help integration with tax apps, estimates, deductions, and filing tools

- Easily integrates with other products including GSuite and Gusto.

- FreshBooks may also offer discount or bundle pricing if you pay in advance, so be sure to check the website for any offers before you sign up.

- While customer reviews on third-party sites are mostly positive for FreshBooks, some users praise the ease of use for customer invoicing, others note ongoing issues with double charging. Other users have expressed that their personal information was compromised in data breaches.

- Good and evil

Pros:

- Easy to use

- There are four subscription levels available.

- Mobile friendly

Cons

- Users complain of being charged twice.

- Data breaches have compromised some users’ personal information.

- Runner-up, best overall

- Intuit QuickBooks

- Intuit Quickbooks

- Sign up now

- Why we chose it

- QuickBooks is another cloud-based accounting software program that also offers separate desktop options that you can purchase and download. Its products are typically designed for small and medium-sized businesses, and more than 7 million businesses use the software.

- We chose it as our runner-up for best accounting software because it’s another program that’s easy to use for business owners with no accounting experience. It’s also quick to set up, reasonably priced, and offers tools and features that are helpful for small business accounting. It keeps everything organized in one place and keeps your business tax-ready throughout the year.

- QuickBooks features include:

- Merger of financial institutions

- Integrations with PayPal, Square, Shopify, and more

- User guides and exporting tax data to help with filing quarterly and annual tax returns

- Sales tax calculations, returns, and recorded tax payments

- Automatically sort transactions and expenses into tax categories.

- Track expenses in one place.